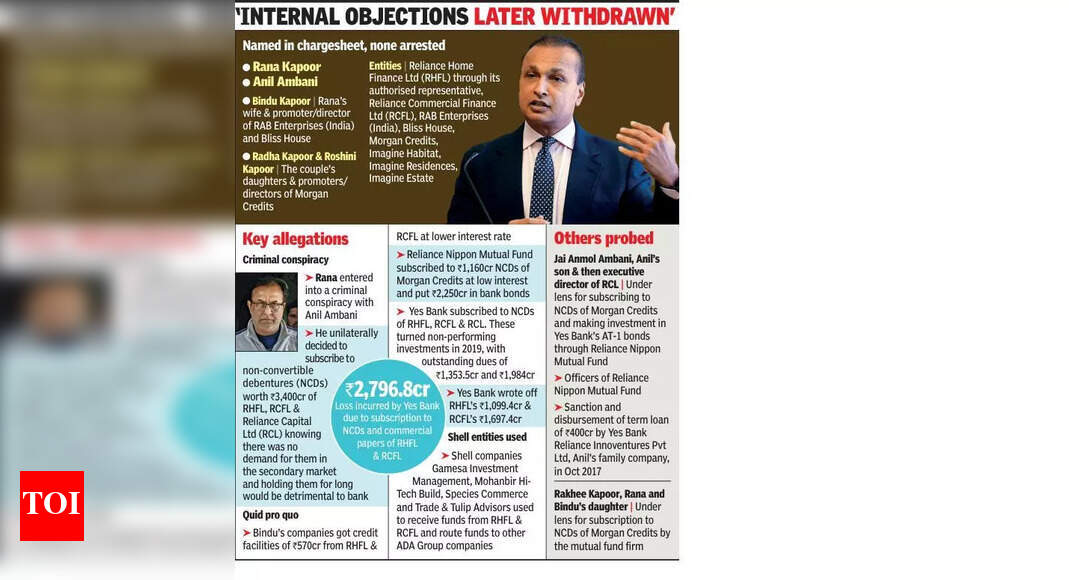

Mumbai: While industrialist Anil Ambani has been chargesheeted by CBI in the Yes Bank loan fraud case, his son, Jai Anmol Ambani, has come under the lens.According to its chargesheet filed recently, CBI said as part of its future investigations, it was probing the role of Jai, then executive director of Reliance Capital Ltd (RCL) when Reliance Nippon Mutual Fund, part of Anil Dhirubhai Ambani (ADA) Group, subscribed to non-convertible debentures (NCDs) worth Rs 1,160 crore of Morgan Credits Pvt Ltd at low interest rate and invested Rs 2,250 crore in Yes Bank’s AT-1 bonds under Anil’s influence as part of a quid pro quo arrangement. Radha Kapoor and Roshini Kapoor, the daughters of Yes Bank’s former MD and CEO, are the promoters/directors of Morgan Credits. CBI also said Anil and Jai interfered in the decision-making process at Reliance Nippon Mutual Fund without informing its Japanese partner, prompting objections and allegations. It said Jai held monthly review meetings with the mutual fund firm’s officers, expressed displeasure over their performance and directed that he be informed of any mutual fund investment of Rs 50 crore or more him prior to execution. This interference led to internal objections, but the directives were eventually withdrawn, said the chargesheet. It alleged that Anil entered into a criminal conspiracy with Kapoor to get the bank to subscribe to his group companies’ NCDs and commercial papers (CPs) worth Rs 3,400 crore “when there was no demand for them in the secondary market”. It alleged that Kapoor pushed for the NCDs’ acquisition, knowing that holding them for an extended period would harm the bank. The chargesheet said in return, Kapoor’s wife, Bindu, received credit facilities of Rs 570 crore from Anil’s companies at a lower interest rate. “…Yes Bank Limited suffered a total loss of Rs 2796.77 crore due to subscribing NCDs & CPs of RHFL (Reliance Home Finance Ltd) and RCFL (Reliance Commercial Finance Ltd),” the chargesheet said. CBI has named 13 accused in the chargesheet, including Bindu, Kapoor, Radha and Roshini. None of them has been arrested. The agency said it is also probing the role of another daughter of the Kapoors, Rakhee. As per the chargesheet, ahead of the NSE listing in 2017 of Reliance Nippon Asset Management—an asset management company (AMC) jointly owned at the time by Reliance Capital and Japan’s Nippon Life Insurance, Sundeep Sikka, then CEO of the AMC, informed Takeshi Furuichi, then vice-president of Nippon Life Insurance, about interference by Anil and Jai in the fund’s investment decisions. Following a business meeting at the office of the ADA Group, Furuichi held a private meeting with Anil. “In this meeting, he made allegation against Anil Ambani and Jai Anmol Ambani for interfering in the investment decision of the AMC,” said the chargesheet. Afterwards, Anil allegedly expressed his displeasure to Yoshinobu Tsutsui, then president of Nippon Life Insurance. The chargesheet said Kapoor and Anil held frequent meetings, but no bank officer attended these. After these discussions, Kapoor instructed his bank officers to process proposals for Anil’s companies, it said. Similarly, Anil allegedly directed key managerial persons in his financial companies to relax terms for loan proposals associated with Kapoor’s family. CBI said in Dec 2016, RHFL issued NCDs worth Rs 3,500 crore and Yes Bank processed a proposal to subscribe to unsecured debentures of Rs 250 crore. Kapoor failed to disclose that his wife’s company had already got an inter-corporate deposit from RCL, for which he was a personal guarantor. The chargesheet also cited a report from The Economic Times highlighting that Reliance Communications Ltd missed loan repayments to local banks, affecting its credit rating and creating an urgent need to arrange long-term debt from other sources. According to CBI, during this period, Reliance Nippon Mutual Fund held sufficient public money for investment in long-term debt instruments. However, Sebi regulations barred investments in securities issued by sister concerns or group companies through private placement. To circumvent this, Anil allegedly conspired with Kapoor to misappropriate public funds held by the mutual fund, using them to arrange long-term debt for his financial companies without the knowledge of the Japanese co-sponsor. CBI alleged that Yes Bank invested Rs 640 crore in the commercial papers of RCFL to support ongoing operations and refinance existing debt. A significant portion of these funds was diverted through a series of transactions involving shell companies and ultimately used by Reliance Infrastructure Ltd to disburse dividends to shareholders, it said. The CBI probe uncovered a complex network of shell companies used to route funds and discharge financial liabilities, all allegedly orchestrated under Anil’s instructions.

https://timesofindia.indiatimes.com/city/mumbai/yes-bank-adag-loan-fraud-anil-ambanis-son-under-cbi-lens/articleshow/124917271.cms