Kotak Institutional Equities expects the quarter to show “anxiety and weakness.” It forecasts annualised premium equivalent (APE) growth of 14% for Axis Max Life and 10% for HDFC Life, while SBI Life, LIC, and ICICI Prudential Life are expected to see APE declines of 1%, 1%, and 4%, respectively.

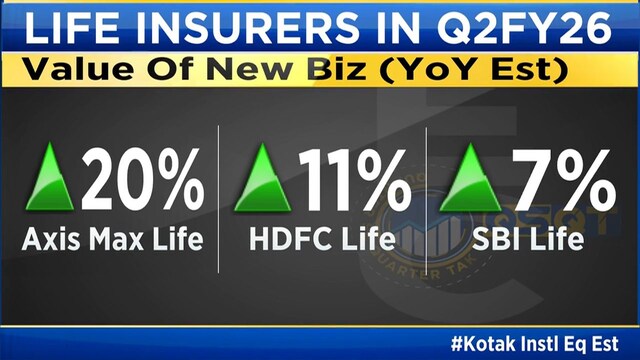

Kotak also expects the value of new business (VNB) growth to remain muted. Axis Max Life may post the strongest VNB growth of about 20%, followed by HDFC Life at 11% and SBI Life at 7%. ICICI Prudential’s VNB growth is expected to stay flat, while LIC may see a 3% decline.

Also Read | SBI Life tops September new business premiums; HDFC Life, ICICI Prudential show mixed growth

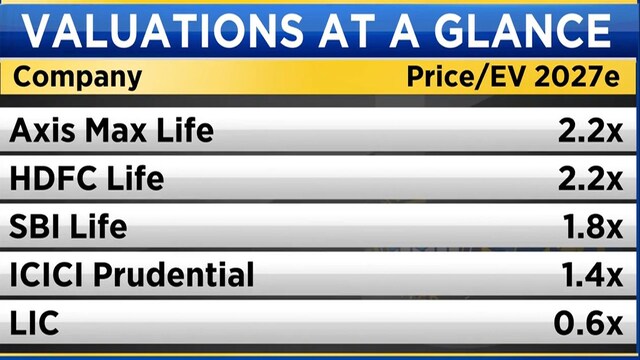

Margins across the industry could drop by 50 to 150 basis points due to the GST-related disallowance of input tax credit (ITC). Valuations remain steady, with Max Financial and HDFC Life

trading around 2.2 times FY27 price-to-embedded value, and LIC around 0.6 times.

Kotak highlighted five key areas to watch: the margin impact of GST changes, cost pass-through to distributors, demand outlook for the second half of FY26, commission trends, and discussions between insurers and the IRDAI on risk capital and expense spreading.

Also Read | Bandhan AMC’s Manish Gunwani sees market in consolidation phase, favors metals and innovation themes

Analyst Nischint Chawathe of Kotak Institutional Equities said, “It’s been a volatile three months. The first month was fine, August volumes were weak, and then we saw some pickup in September.” He added that industry growth looks modest year-on-year but is stable on a two-year basis at around 15% CAGR.

Chawathe said the focus now is on how demand evolves after the GST revisions. “Prices have gone down for term, health, and some other products. The question is whether that helps stimulate demand,” he noted. He added that the sharing of ITC losses between distributors and insurers remains uncertain and will be an important trend to track in the coming months.

For the full interview, watch the accompanying video

Catch all the latest updates from the stock market here